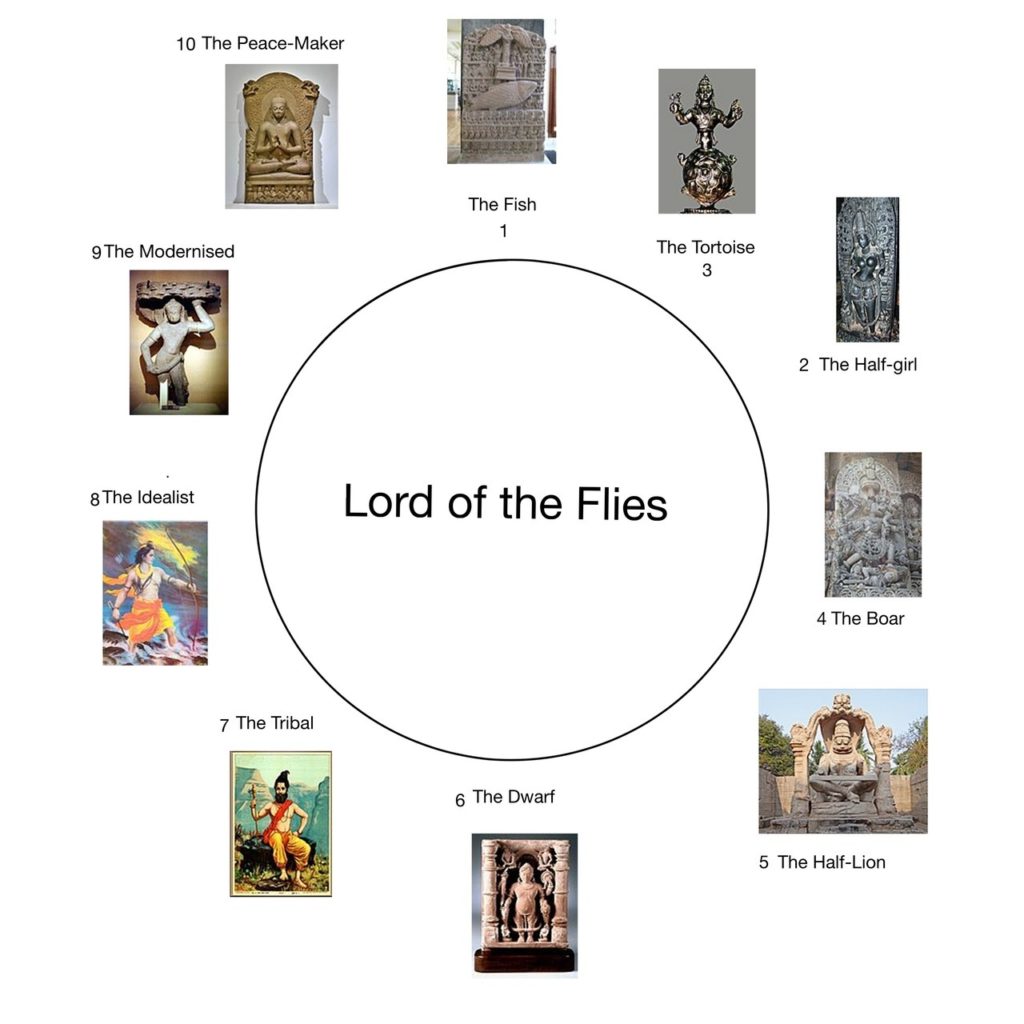

10 Avatars

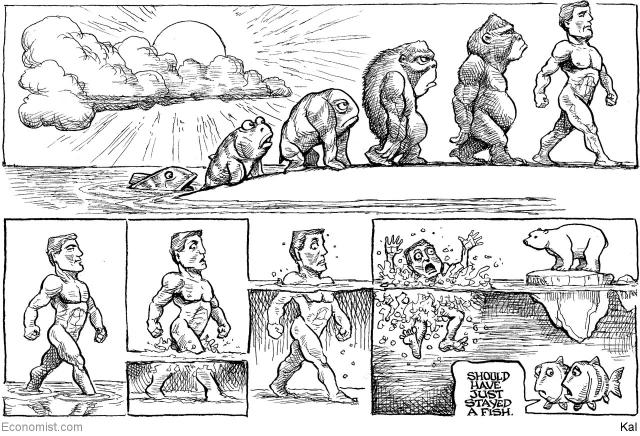

Its well known that before Darwin Indian’s have done a lot of Alchemy and Ayurvedic research with little to no manuscripts as most have been turned to ash by those who couldn’t comprehend the depth of the code that was embedded. There is one such loophole with the 10 avatars if you ask anyone even the illiterate they would say the order of the Avatars of Vishu except for 1 who’s name is never taken except for the ones who are neither He or She. The order of the avatars can be places thus as seen in the images above with this missing link. To begin…

1.Matsya or the Supercell as i would like to call is neither Male or Female its a primitive bacteria or single cell that clones itself like the clone army in StarWars. Then comes the real question that even Einstein keeps questioning is it the Hen or the Egg? So to add some context there were 2 avatars that were born when the holy churning of the milky way happened.

As you can see in the image above from right to left exactly in the middle of the canvas you see a serious of All men holding what looks like a snake and that is wrapped around a pointy object which would resemble as a mountain for some. cough… cough… and all of those men (not woman) have being doing something. So the story goes like this men were churning an ocean of milk that would give them an elixir called Amrutha which would give them immortality in another way the exact story can me told that. There was a time when we have only single cell or clone army like starwars and they were on verge of extinction. Or Single cell organism have gotten some poison or some form of virus that was destroying them and then some thing happened …

2, 3 avatar The second avatar is actually something called “Hermaphrodite” in this era context its called “Mohini”. The prior mentioned organism (Hermaphrodite) are a special kind or organism that have both male and female organism and the best example of them is the most famous ClownFish Aka Nemo and Merlin from “Finding Nemo” then again this is not brought out into the open as the rest of the sequence are all animal and male hybrids that slowly progress. But let’s not get ahead so when the event happened there was another avatar that is the Kurma or Tortoise! So we can see the order as 2. Mohini, 3. Tortoise. 3rd that is an amphibian that was first which tried to move to the land. To be precious “Turtles” like Ninja turtles were the ones that use to lay eggs on the land and then go back to Ocean/Sea. I would like to use a term “metamorphosis” rather then evolution for just sake or simpleton conversation like the caterpillar that become a butterfly the Supercell or single cell become a “XY” and “XX” chromosomal combination they can be for fluidity in my story as sex is a fluid concept and there are several mutations of question that have happened. You can say the cell became non reproductive or lost its cloning gene and hence we have the male then again like I said its a fluid research topic and then we have the billon swimmers that rush to the egg. This part of the story is grey area and hence they left it that way I presume. But after the whole Single Cell to Dual cell then came multicellular which were obviously the trend and rage and there is not story about that grey area. Then we have the obvious Turtle as olive Turtles are frequent visitors here and there the dots connect back as there could be some history that land was much safer and water was filled with dinosaurs sharks and killer whales of sorts aka Big Fish. So the Ninja turtles decided to move south i mean to towards the land first for laying eggs. Then growing legs and lungs. Metamorphosis from fish –> twin fish(yin yang or guy/girl) then –> land fish tortoise/turtle. They could have used a crocodile as well for this but…

Then the 4th avatar is the Boar or Javelina’s or “Timon and Pumbaa” Pumbaa the big fart began the one that would be in swamps and shallow water. A being that was able to breath in water and on land and could walk all over with filthy dirt all across. Something that can live for longer durations on the land then in the ocean they are several Boar, Hippopotamus etc

The 5th was unique this was a half Human and Half lion but mostly this resembles the philosophical dominant predator playground on the land like in the ocean, the lion was the most fierce and most common top predatory that even the early apes might have feared and for some reason this is divided into Lion and Human or lost in translation as humans with barbaric mane that resembled the lion. Then again this could be looked at to say that in order to survive the evolution brought back the meat eaters to the land as well and that herbivores have grown abundant and needed a balancer. The symbolism depicts a half lion eating human a Cannibal.

Then 6th The dwarf this avatar accounts to the finding of Homo Erectus or some form of evidence that might have been brought from china to India by some Monk who enlightens the Raja Raja’s as per the story but this also signifies the first ape that moved to land from tree tops landing its feet onto the ground “like” Lucy ape.

Then 7th is a tribal from here the philosophy of nature becomes a philosophy of human society and their transition. This avatar is a tribal who would cut wood and chop trees knows how to do agriculture and gather food which is most common feature that is most understood as tribal. But there is still this person also has an extreme rage and animal instinct who would kill indiscriminately like a raging bull or elephant. Aka “animal instinct” who kills like a “psycho” but is also has the power and knowledge of all the tools unlike the dwarf.

Then 8th is most well known and most admired as the perfectionist this avatar resemble the golden age of knowledge and prosperity when peace was paramount and people needed a reason to kill people along with apes and animals alike but trained one’s. This is the time the shape of society, the meaning of a democracy and people welfare was taking its roots yet war and killing with “animal instinct” was there.

Then 9th this was the fall of the perfectionist phase and the birth of what i call the pablo picasso the surrealism and nihilism was rampant the “rules” no longer had meaning and the society that was obsessed with perfection and what is the right thing to do has reached a dead end! where the “animal instinct” creeped back into the society they did not need any rule to fight a war they just fought this period can be quoted as “Everything is fair in love and war” except by the blues!

Our society started from a small tribe that branded themselves like Just do it Nike or Adidas brands like in Unsullied GOT~ish except with long necks, tattooed and animal like branding then several such joined hand and created town and villages and then the mixed people further created cities where most of history was born. “Cities” in Egypt or Babylon etc were actually called Nationality by themselves and tribals themselves claim a Nationality. Then at slow pace certain town and cities then they turned into States we see today that called themselves into a nation and finally when we have crossed all the oceans and seas in under 80 days and there was nothing to see we defined nations as per UN definitions. Who know’s tomorrow Continents will become the new Nationalism.

Last avatar or still coming avatar

There is this debate as to whether they will be a real god or alien as some would prefer or a dramatic comet and meteor shower that can destroy the civilisation, that currently exists, that would give rise to the next savour! The last is always the most complicated.Some would turn to Western gods as the last. But as per the last by “Ashoka the great” who has taken the pain at spreading the knowledge of sciences like most of the other avatars the point of peak moment it all comes to the standard set. That is a break through of knowledge and science. Eureka moment or E = MC^2 moment.

10th avatar the Gautam buddha a man who was born as a prince and becomes a sage who forgo’s everything worldly and establishes a systems of voting that was never heard off he was Gautam Buddha. According to various accounts by historians. Unlike Athens or Roman in India he is considered the architect of Democracy. The ashrams that he established or monasteries to say are the once that elected the sutras and dharma based on a voting system by hand. Yes, they used to raise there hand and a counter would count the response or votes of the attendees and they would become rules or Siddhanta that would have to be followed by all and this spread everywhere during the period of Gautam buddha and this was considered as the most perfect constitution and knowledge even by the expansionist and emperor Ashoka and was considered the Last Avatar. The proof you ask lies in the rest of Asia everywhere starting from Myanmar to China and even pacific islands. The medical document and historical relevance all abet improved or modified to meet their local context leaves a trail.