Oct.28 — Ira Epstein, director of Ira Epstein division at Linn & Associates, discusses palladium surging to a record high, extending a rally that has seen prices continue to hit fresh records. He speaks with Bloomberg’s Vonnie Quinn on “Bloomberg Markets.”

Metal Refining & Recovery, Episode 22: 15,500$ in Gold?

Gold ETF – The best bet for a prosperous future

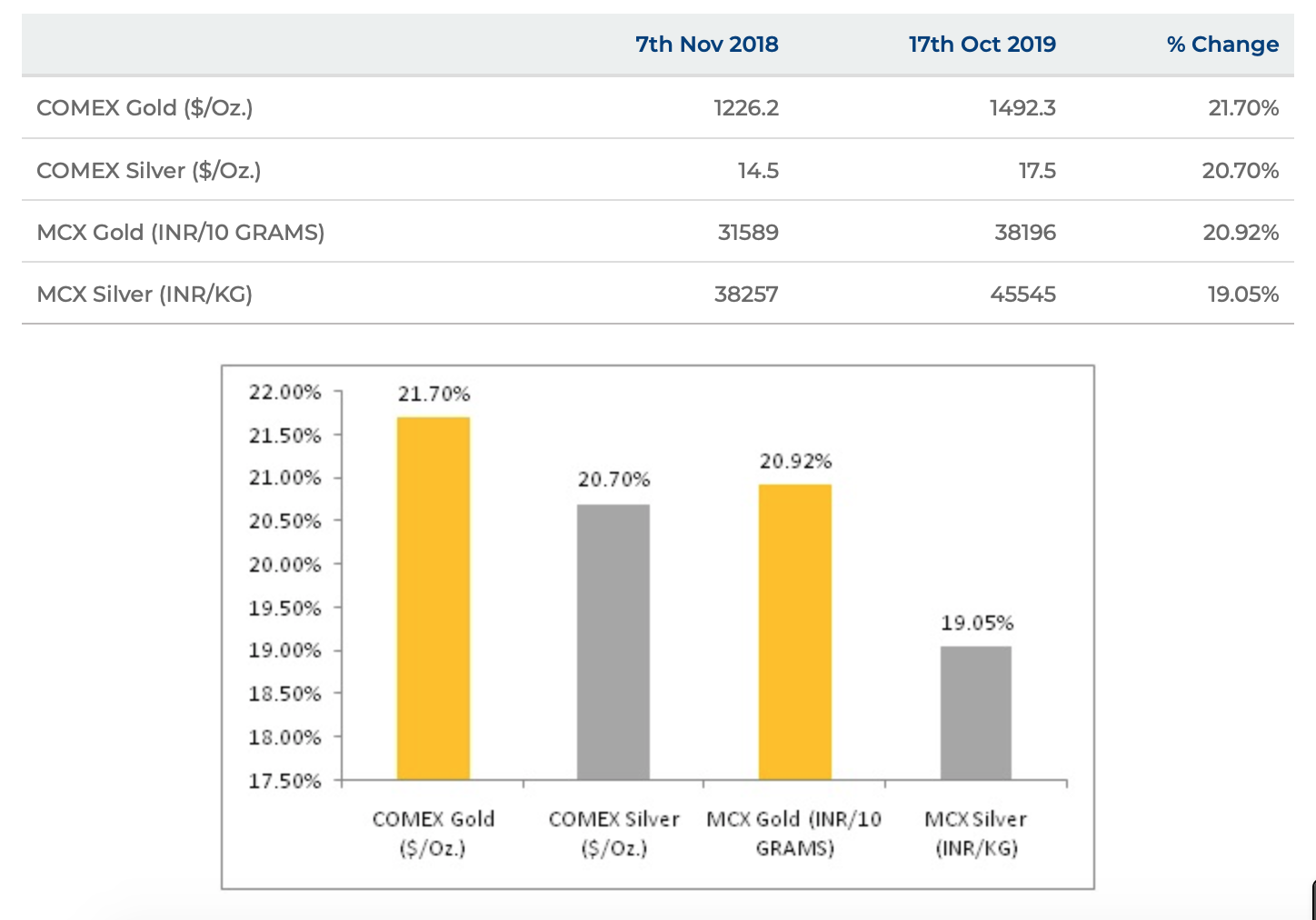

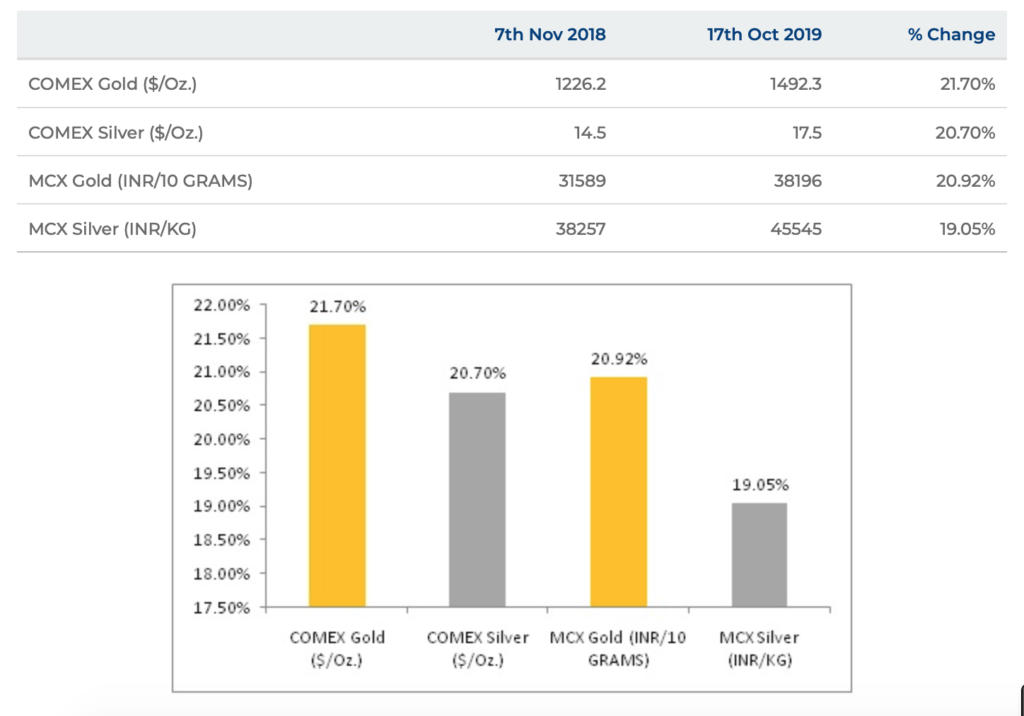

The year 2019 has been the year of bullion for the global commodity market wherein gold and silver prices staged a strong rally. A host of events that took place across the globe such as extension and intensification of Sino-US trade, geopolitical tension in the Middle East, US sanction on Iran, Nigeria, Venezuela, an extension of trade dispute of the US with Europe, Mexico and India attracted more buyers of gold. Weakening of global economic condition as measured by GDP, inflation, labor market condition, trade balance, etc. also attracted increased investment into the bullion market in general and gold in particular. As a result, the CME gold prices surged by 21.70% since closing on Muhurat Trading in 2018 i.e. on 7th November, 2018 till 17th October, 2019 while silver gained by 20.70% in the same period. On domestic market, MCX gold futures gave a return of 20.92% since Muhurat Trading of last year till 17th October, 2019 and silver surged by 19.05%. The details are presented in the table below.

The International Monetary Fund (IMF) has lowered the global economic outlook through its quarterly reports. In its April World Economic Outlook report, IMF lowered global growth forecast to 3.3% for 2019 from 3.6% in 2018 and for the year 2020, the projections were made at 3.6%. These projections were revised lower by 0.1% to 3.2% for 2019 and 3.5% for 2020 from April 2019 forecast. In the latest World Economic Outlook report released on 15th October, 2019, growth projection for 2019 was kept at 3.0% and for 2020 it was projected at 3.4%. Gloomy economic condition attracted yellow metal as the best investment option among asset classes.

On trade-related activity, the US and China kept on retaliating by imposing additional tariffs on import of goods and services. There were several rounds of discussion that took place at different levels including the meeting between US President Donald Trump and Chinese Premier Xi Jinping. However, both the sides failed to end the more than 1 ½ years trade dispute. Though there was a temporary relief in the form of delay in imposition of additional tariff, agreement between both the countries on buying the products and services did not really have a major impact on the market.

As the economic condition was worsening, the central banks stepped in to bring the economy back onto the growth trajectory through easing monetary policies. At the beginning of 2019, the US Federal Reserve was on the course to keep its interest rates rising. However, the stance was changed in second half of the year wherein it slashed interest rate by 25 basis points each in July and September 2019. This has resulted in fall in the US Treasury Yield of 2-year and 10-year to multi year lows thereby attracting investment flow into the bullion market.

Indian gold market follows the trend of international market and so the rally seen in global market was witnessed in the Indian market as well. The gold in international exchange rose to a 6-year high in 2019 while on MCX, the prices rallied to an all-time high thanks to the depreciation of Indian Rupee against the US Dollar. Apart from this, another factor that led to the rally in Indian gold was change in import duty on gold. During the second term of Modi government, the Finance Minister Smt. Nirmala Sitharaman in her maiden budget speech raised the import duty on gold and silver to 12.5% from earlier 10%. This rise in import duty sent shocking signals to the bullion market wherein the market participants were expecting cut in the import duty.

The economic outlook is still bleak for major countries and this is prompting the central banks to step in to further ease the monetary policy. This step will attract further buying in gold and silver in the days to come. Recovery in the global economic conditions as well as end of trade war between US and China will change the trend in gold and silver.

This festive season, invest in gold via the ETF route.

Investment Required:

Investors can invest in Gold ETFs with a minimum investment of around Rs. 350 (1Mili Gram) and multiples thereof.

Advantages of buying Gold ETF:

1. Transparency in pricing

2. Available in Demat form

3. No fear of theft

4. Minimal or no charge of Buying and Selling

5. Prices of the ETF are closer to Spot Gold /Actual Gold

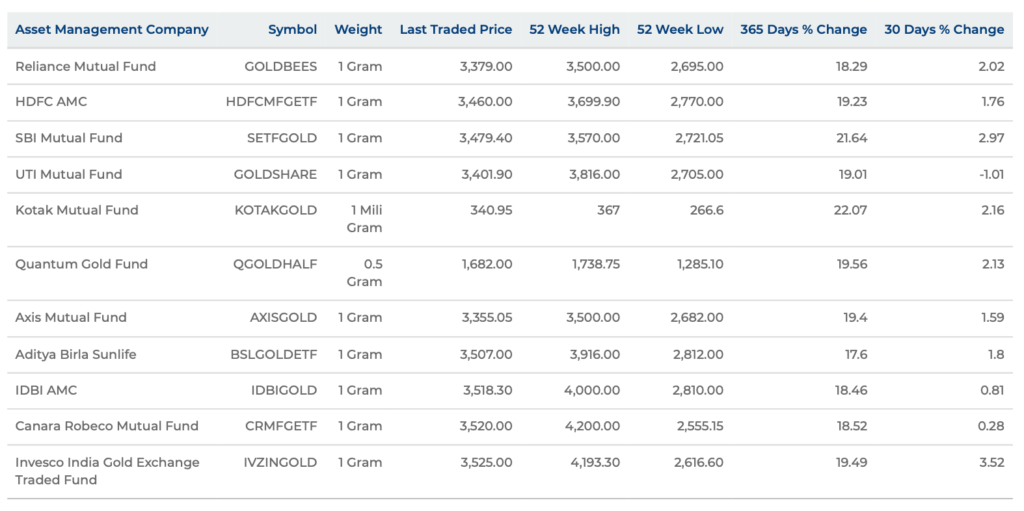

Invest in gold via ETF this Diwali and harvest future gains. Below is the list of ETFs as per the liquidity and returns over the past one year. Investors can choose Gold ETFs from the list below:

*list is as per traded value of the ETFs

Golden Lanka (රන් ලංකා)

දඹුල්ල රජමහා විහාරය

දඹුල්ල රජමහා විහාරය , ශ්රී ලංකාවේ මධ්යම පෙදෙසෙහි මාතලේ දිස්ත්රික්කයේ පිහිටා ඇති රජමහ විහාරයකි. මෙම අඩවිය කොළඹට කි.මී 148ක් ඊසාන දෙසින් හා මහනුවරට කී.මී 72ක් උතුරු දෙසින්, පිහිටා ඇත. මෙය ශ්රී ලංකාවේ විශාලතම හා හොඳින්ම සංරක්ෂණය කෙරුණු ලෙන් විහාර සංකීර්ණයයි. හාත්පස පිහිටි තැනිතලාවෙන් මතුවන ගිරිශිඛරය මී160 ක් අහස උසට පැන නගියි. මෙහි අවට ප්රලේඛගත ලෙන් 80 කට වැඩිගණනක් ඇත. මේ අතුරින් පිළිම හා සිතුවම් අඩංගු ලෙන් 5ක් තුල ප්රධාන ආකර්ෂණ අඩංගු වී ඇත. මෙම සිතුවම් හා පිළිම බුදු රජාණන් වහන්සේ හා උන්වහන්සේගේ දිවිය හා බැඳුනු ඒවා වෙති. මුළුමනින් බුදු පිළිම වහන්සේ 153 ක්ද, ශ්රී ලාංකික රජවරුන් 3 දෙනෙකුගේ පිළිමද හා දේවතා සහ දේවිතාවන්ගේ පිළිම 4ක්ද මෙහි වෙති. පසුව සඳහන්වූ 4 අතර, විෂ්ණු හා ගණ දෙවි යන හින්දු දෙවිවරුන්ගේ පිළිම දෙකක් ද වෙති. බිතු සිතුවම් 2,100 මී² ක වර්ග ඵලයක් සහිත පෙදෙසක පැතිර පවතී. බිත්ති වල දක්නට ඇති සංවර්ණන අතර මාර යකු විසින් බුදු රදුන් පෙලඹවීමට ගත්තැත හා බුදු රජාණන්ගේ පළමු ධර්ම දේශනාව දැක්වේ.

දඹුල්ල ලෙන් සංකීර්ණය අසබඩ ඉබ්බන්කටුව ප්රදේශයෙහි වසර 2700 නට වඩා පැරැණි (ක්රි.පූ 700) මානව ඇටසැකිලි සහිත සුසාන භූමි සොයාගෙන ඇති බැවින්, බුදුසහම ලංකාවට අවතීර්ණ වීමට පෙරාතුව, මෙම ලෙන් සංකීර්ණ තුල, ප්රාග්-ඓතිහාසික ශ්රී ලාංකිකයන් දිවි ගෙවූ බව අනුමාන කල හැක.