Gold in the form of jewellery is not only used as a wearble but also works as a tool to tide over financial emergencies. So, buying gold has traditionally been a financial support system over the years.

There are ways of owning gold – paper and physical. You can buy it physically in the form of jewellery, coins, and gold bars and for paper gold you can use gold exchange traded funds (ETFs) and sovereign gold bonds (SGBs). Then there are gold mutual funds (fund of funds) which further invest in gold ETFs. There are gold MFs (fund of funds) which invest in the shares of international gold mining companies.

For buying physical gold, one may reach out to the neighbourhood jewellers. Few jewellers allow placing an order on their websites too. Further, there are e-commerce websites such as Amazon India, Paytm and Snapdeal where one can buy gold coins online to get the coins delivered at home.

PHYSICAL GOLD

Jewellery

Indians certainly cherish possessing gold. But owning it in the form of jewellery has its own concerns about safety, high costs, and outdated designs. Then there are the ‘making charges’, which could prove to be a costly affair. The making charges on gold jewellery, which typically ranges between 6 percent and 14 percent of the cost of gold (may go as high as 25 percent in case of special designs) are irrecoverable.

Gold Coin Scheme

Gold coins can be bought from jewellers, banks, non-banking finance companies, and now even e-commerce websites. The government has launched ingeniously minted coins which will have the National Emblem of Ashok Chakra engraved on one side and Mahatma Gandhi on the other. The coins are available in denominations of 5 and 10 grams while the bars will be for 20 grams.

The Indian Gold Coin and Bar will be of 24 karat purity and 999 fineness carrying advanced anti-counterfeit features and tamper proof packaging. All coins and bars will be hallmarked as per the BIS standards. These coins are distributed through designated and recognised MMTC outlets and through specified bank branches and post offices. MMTC also offers a transparent ‘buy back’ option for Indian Gold Coin through its own showrooms across India. MMTC will repurchase the Indian Gold Coin, in intact tamper proof packaging and with original invoice, at the prevailing gold base rate.

Gold savings schemes

Gold or jewellery savings schemes come in two forms. A typical one allows you to deposit a fixed amount every month for the chosen tenure. When the term ends, you can buy gold (from the same jeweller) at a value that is equivalent to the total money deposited, including a bonus amount. This conversion is done at the gold price prevailing on maturity. In most cases, the jeweller adds a month’s instalment at the end of the tenure as a cash incentive or may even offer a gift item.

PAPER GOLD

Gold exchange traded funds (ETF)

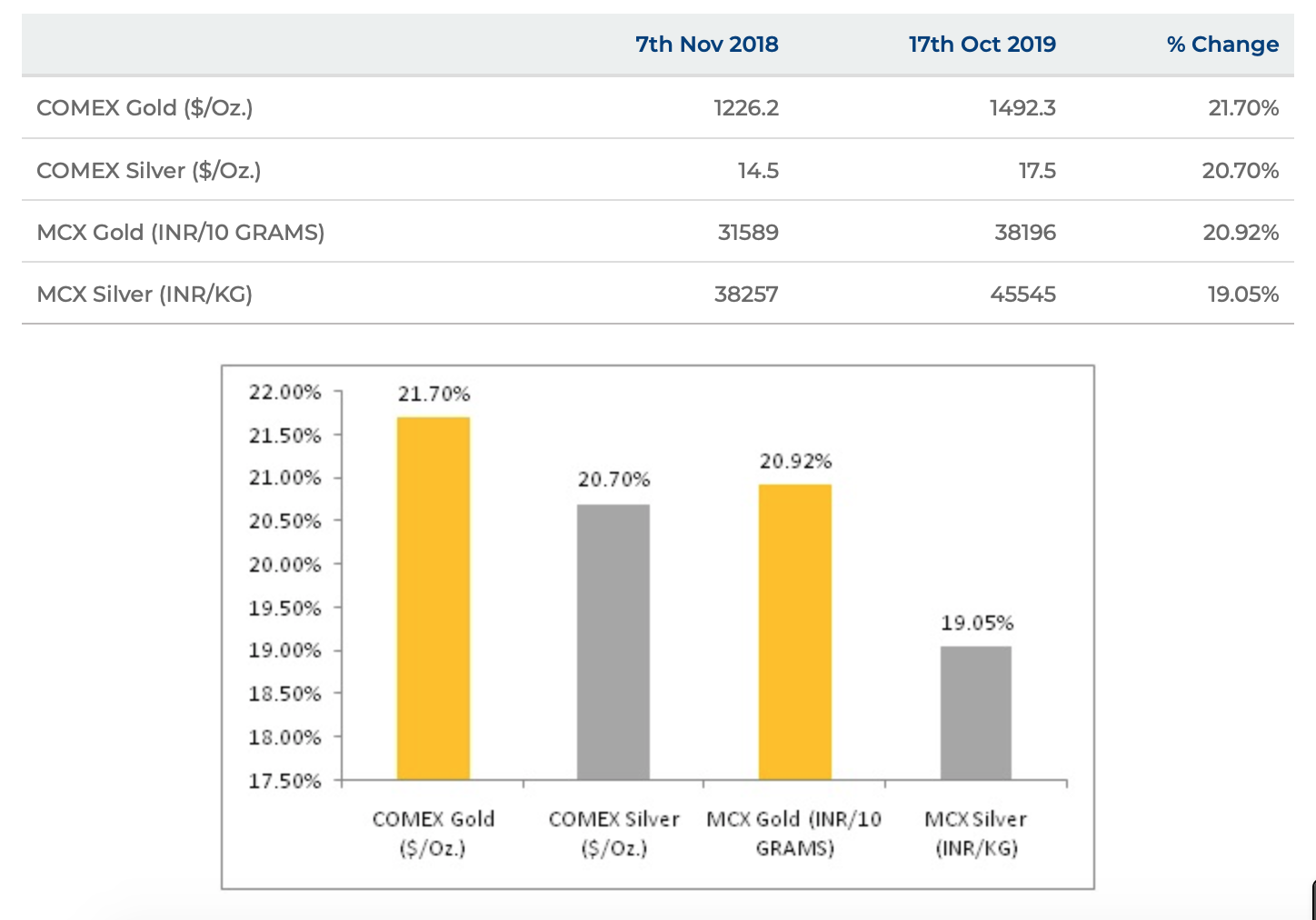

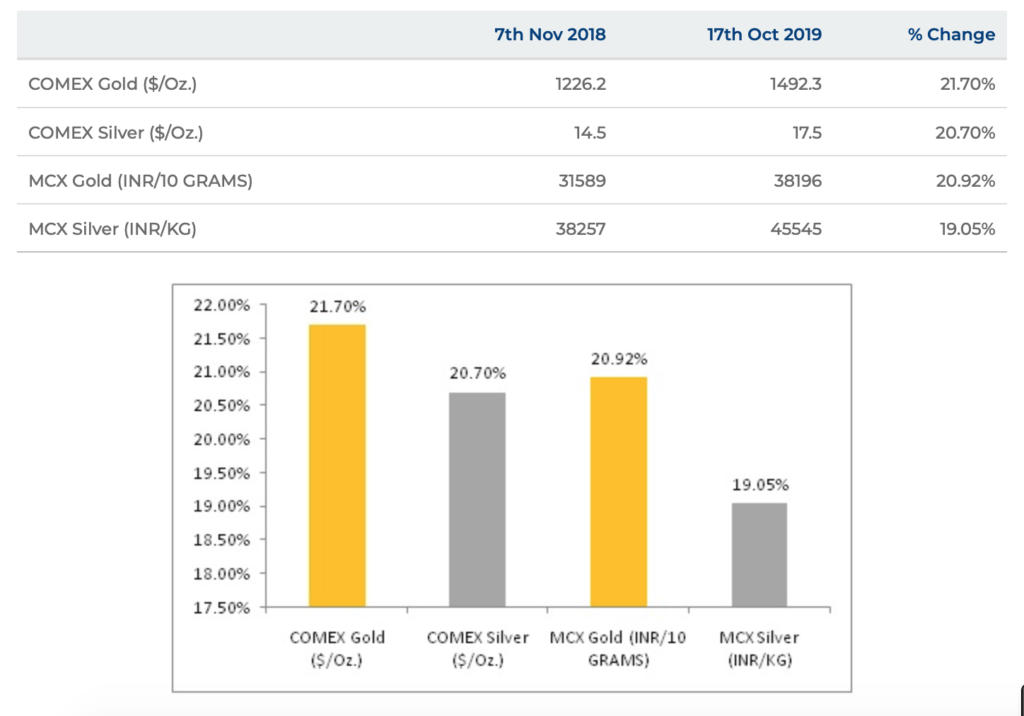

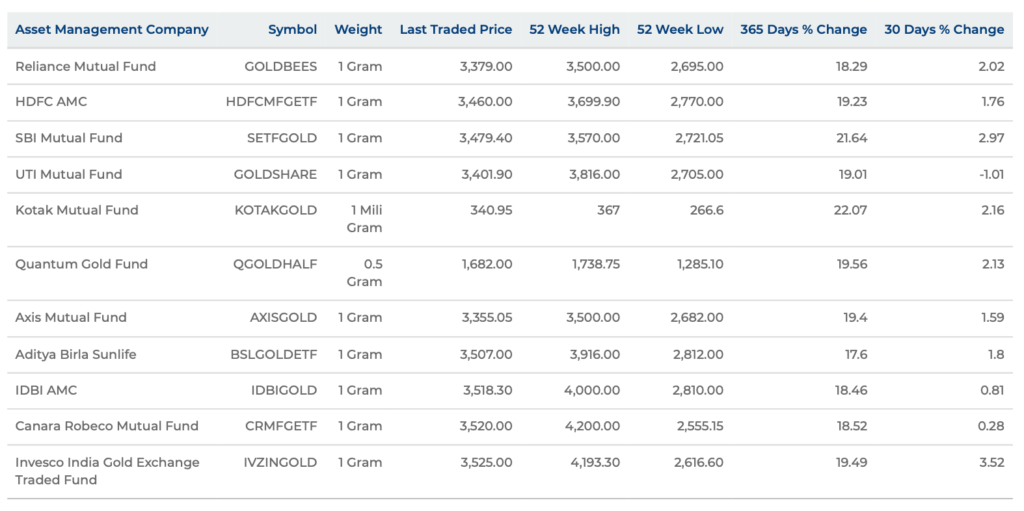

An alternate way of owning paper gold in a more cost-effective manner is through gold exchange traded funds (Gold ETF). Such investments (buying and selling) happens on a stock exchange (NSE or BSE) with gold as the underlying asset. What’s more, the high initial buying and even selling charges that go into owning jewellery, bars or coins gives an extra edge to the low-cost gold ETF. The transparency in pricing is another advantage. The price at which it is bought is probably the closest to the actual price of gold and therefore the benchmark is the physical gold price.

What you need is a trading account with a stock broker and a demat account. One may either buy in lump sum or even at regular intervals through systematic investment plans (SIP). You may even buy 1 gram of gold.

Even though there are no entry or exit charges there are three costs that come with gold ETFs. One is the expense ratio (for managing the fund) which is generally low compared to other mutual funds and is around 1 percent. Second, is the broker cost that needs to be accounted for every time you buy or sell gold ETF units.Third, which technically is not a charge but impact returns is the tracking error. It arises because of the fund’s expenses and cash holdings thus not mirroring actual gold price.

Sovereign Gold Bonds (SGB)

Sovereign Gold Bond is another way of owning paper gold. They are issued by the government but availability is not ‘on-tap basis’. Instead, the government will intermittently open a window for the fresh sale of SGBs to investors. This could typically happen every 2-3 months and the window will remain open for about a week. For investors looking to purchase SGBs anytime in between the only way out is to buy earlier issues (at market value) which are listed in the secondary market.

Digital gold

You can now purchase gold coins, bars and jewellery online. ‘Digital Gold’, is offered on the mobile wallet platform of Paytm and ‘GoldRush’ is offered by the Stock Holding Corporation of India on their website, while Motilal Oswal has launched Me-Gold, a digital gold online investment. All of these are offered in association with MMTC – PAMP, (a joint venture between public sector MMTC and Switzerland’s PAMP SA)

Making a choice

The initial cost of owning physical gold in the form of bars or coins is anywhere around 10 percent and it is even higher for jewellery. SGB and Gold ETF, both paper-gold, are cost effective as there is no entry cost in SGB while costing for gold ETF could be around 1 percent.

SGB should benefit those who want to invest in gold for a longer period as its maturity is after 8 years, although the lock-in ends from the fifth year. However, gold ETF provides much better liquidity than SGB. Owing units is much easier than SGB as it’s entirely online in case of ETFs. The risk of owning, holding also doesn’t exist in both.

The big difference is on the taxation front. Gains in SGB on redemption are tax-exempt but gains in Gold ETFs after 3 years are subject to 20 percent tax post indexation.

The only disadvantage with gold ETFs is that its units won’t be earn the additional interest of 2.5 per cent per annum like you would get for SGBs.

Get clarity as to why you need to invest in gold – is it for marriage purpose or for pure investment. For investments, one should not have more than 10 percent of the total portfolio in gold. Choose between Gold ETFs or SGBs depending on how comfortable you are managing investments online and keep the worries of purity, security aside.

Courtesy: Economic Times (ET)