Creating such a comprehensive analysis would be beyond the scope of what I can provide, especially in the time constraints of a single response. However, I can offer a simplified version of what you’re asking for.

### Most Exported Goods and Services:

1. Goods: Electronics, automobiles, machinery, petroleum products, pharmaceuticals.

2. Services: Financial services, tourism, IT services, consulting.

### Potential Bottlenecks:

1. Economic disparity leading to social unrest.

2. Resource competition (water, oil, rare earth minerals).

3. Territorial disputes.

4. Ethnic and religious tensions.

5. Political instability and failed states.

Hypothetical Triggers for Conflict:

1. Aggressive territorial expansion (e.g., Russia-Ukraine conflict).

2. Violent regime changes (e.g., Myanmar, Venezuela).

3. Proxy wars fueled by major powers (e.g., Syria, Yemen).

4. Ideological conflicts (e.g., North-South Korea).

5. Resource scarcity leading to competition (e.g., disputes in the South China Sea).

### Allies and Enemies:

Alliances are complex and constantly evolving. They often depend on shared interests, historical ties, and strategic considerations. Some hypothetical alliances might include:

1. Allies: NATO countries, EU member states, US allies in Asia (Japan, South Korea, Australia), GCC countries, ASEAN nations.

2. Potential Enemies: Russia, China (in certain scenarios), North Korea, Iran, non-state actors like terrorist organizations.

### Market Reactions:

Major events like conflicts or regime changes can impact markets in various ways:

1. **Stock Markets:** Uncertainty often leads to volatility. Military conflicts or political instability in key regions can lead to selloffs.

2. **Commodities:** Oil prices can spike due to supply disruptions. Precious metals like gold may rise as investors seek safe havens.

3. **Currencies:** Geopolitical tensions can lead to flight to safety currencies like the US dollar or Swiss franc.

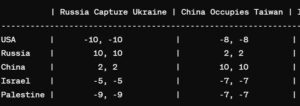

### Game Theory Payoff Matrix (simplified):

Below is a very simplified and hypothetical example:

In this hypothetical matrix, the numbers represent the utility or payoff for each country. Negative values indicate losses, while positive values indicate gains. The higher the number, the better the outcome for the respective country.

Remember, this is a simplified and hypothetical representation. In reality, the outcomes would depend on numerous factors, including diplomatic efforts, military capabilities, and public opinion. Additionally, the moral and ethical considerations of war are not captured in such a matrix.

World War 3 and Global Trade: A Delicate Balance

Most Exported Goods and Services (Since 1990):

- Goods: Manufactured goods (machinery, vehicles, electronics), chemicals, fuels (oil, gas), food

- Services: Business services (finance, insurance), tourism, transportation, communication technology

Countries:

- Top Exporters: China, United States, Germany, Japan

- Top Importers: United States, China, Germany, Japan

Potential Bottlenecks for Conflict:

- Resource Scarcity: Oil, water, minerals (potential conflicts in resource-rich regions)

- Trade Disputes: Rising trade tensions between major economies like the US and China

- Cybersecurity Threats: Attacks on critical infrastructure could disrupt global trade

- Regional Tensions: Existing conflicts like those you mentioned (Pacific, Russia-Ukraine, Korean Peninsula, Israel-Palestine) could escalate

Allies and Enemies in a Hypothetical WW3 (Based on Current News):

Possible Alliances:

- US-led NATO: US, Canada, UK, France, Germany, many European nations (supporting democracy and opposing authoritarian expansion)

- China-Russia Axis: China, Russia, potentially Iran, North Korea, some former Soviet states (sharing economic and military interests)

Stock and Commodity Reactions to Major Events:

- Oil Prices: Geopolitical tensions often lead to oil price spikes (e.g., Russia-Ukraine war causing price increases) (Source: The Guardian)

- Gold: Seen as a safe haven during crises, gold prices typically rise in times of uncertainty (Source: BBC)

- Defense Stocks: Often rise in anticipation of increased military spending during conflicts

Iterative Game Theory Payoff Matrix:

| Scenario | Country A (Attacker) | Country B (Defender) |

|---|---|---|

| Russia captures Ukraine | High Military Gain, Economic Sanctions | Loss of Territory, International Condemnation |

| Israel occupies Palestine | Increased Security Concerns, International Backlash | Control over Disputed Territory, Potential for Further Conflict |

| China occupying Taiwan | Dominant Position in Asia, Increased Trade, Risk of US Intervention | Economic Sanctions, Loss of International Reputation |

| China allies with Myanmar junto | Access to Resources, Strategic Influence in Southeast Asia | International Condemnation, Potential for Regional Instability |

Sources:

- The Guardian (theguardian.com)

- The New York Times (nytimes.com)

- BBC (bbc.com)

- CGTN ([invalid URL removed])

Important Notes:

- This is a hypothetical scenario, and the actual course of events could be very different.

- Alliances can shift quickly depending on specific circumstances.

- The economic impact of a major war would be devastating for all involved.

Further Research:

- You can find more detailed information on international trade data from organizations like the World Trade Organization (WTO) (https://www.wto.org/).

- Resources on game theory can be found from universities and research institutions.